Crypto market crash. The cryptocurrency markets have seen a significant. Decline in recent weeks, which has shaken investor confidence and led to massive sell-offs. The prices of Bitcoin, Ethereum, and many others. Cryptocurrencies have sharply declined as a result of the combined effects of growing. Geopolitical unpredictability and escalating regulatory demands. This decline demonstrates how vulnerable the cryptocurrency ecosystem is to increased government interference and worldwide turmoil.

Geopolitics and Crypto

Geopolitical events have significantly influenced the sentiment of financial markets, and this is also true of cryptocurrencies. Investors throughout the world have been uneasy in recent months due to rising disputes and diplomatic tensions.

The ongoing conflict in Eastern Europe is one of the main causes of instability. Because the war disrupts supply chains, particularly in the oil markets, inflation has. Skyrockete, and central banks have been compelled to tighten monetary policy. Many investors are turning away from high-volatility assets like cryptocurrencies in favor of more conventional safe havens like gold or the US dollar as a result of these macroeconomic reasons, which have reduced their risk appetite.

Additionally, heightened tensions in the Asia-Pacific area — particularly between China and Taiwan — have increased fears. Because of its extensive mining activities and impact on global commodities flows, China continues to be a major participant in the cryptocurrency industry. Any increase in this geopolitical hotspot fuels market anxiety by generating concerns about possible disruptions to mining operations and the liquidity of digital assets.

Crypto market crash. Additionally, investors are being cautious due to the unpredictability of international trade ties, sanctions, and diplomatic sanctions. These real-world geopolitical factors are having an increasing impact on cryptocurrencies, which were formerly thought to be a hedge against traditional financial instability. This has resulted in price fluctuations and decreased enthusiasm.

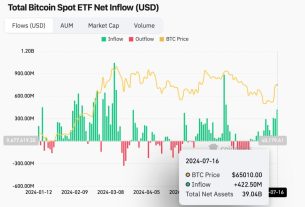

Reduced trade volumes, which suggest hesitation and lower involvement, exacerbate this downward trend. In the face of uncertainty, many traders have either made money or switched to stablecoins and fiat currencies. The market has been further shaken by the recent collapse of.S several cryptocurrency hedge funds and lending platforms were having trouble with liquidity and over-leveraged positions.

According to technical analysis, bearish sentiment has intensified as Bitcoin has dropped below important support levels. Widespread investor nervousness is reflected in the market indicators. Such is the Crypto dread & Greed Index, which has sharply moved toward “severe dread.”

Meanwhile, open interest in short positions has surged, indicating bets on further price drops, and the derivatives markets have seen greater volatility. Because of the feedback loops created by this environment, bad news can increase selling pressure and, in the short term, drive prices even lower.

Diversification and caution are essential for investors navigating this unstable environment. Because these variables are likely to continue to influence price changes. Market watchers advise keeping a careful eye on geopolitical events and regulatory developments.

Current declines may be seen by long-term investors as. Buying opportunities, especially for projects that have solid development communities and practical use cases. On the other hand, traders may think about using risk management strategies like position sizing and stop-loss orders to reduce negative exposure.

Because stablecoins and controlled exchange tokens have. Proven more resilient in the face of market volatility, investors should also be cautious of their expanding influence. Furthermore, because of their speculative nature, exposure to developing industries like NFTs, gaming, and metaverse projects necessitates close examination.

Final thoughts

The complicated environment in which digital assets exist. Function is highlighted by the recent. Decline in cryptocurrency markets. This was driven by regulatory constraints and geopolitical unpredictability. Even if the short-term prognosis can appear difficult, this stage is a normal aspect of the crypto industry’s development.

Despite being sources of volatility. Geopolitical concerns and governmental laws eventually aid in defining the parameters that allow the ecosystem to thrive. Both developers and investors must continue to innovate while adjusting to these realities.

Geopolitical unrest and regulatory crackdowns have had a direct impact on the dynamics of the bitcoin industry. Bitcoin, often regarded as the flagship digital asset, has experienced a sharp decline, falling more than 15% from its most recent peak. Even more precipitous drops have been experienced by Ethereum and other cryptocurrencies, with some seeing value losses of over 20%.

Geopolitical unrest and regulatory crackdowns have had a direct impact on the dynamics of the bitcoin industry. Bitcoin, often regarded as the flagship digital asset, has experienced a sharp decline, falling more than 15% from its most recent peak. Even more precipitous drops have been experienced by Ethereum and other cryptocurrencies, with some seeing value losses of over 20%.