Bitcoin exchange-traded funds (ETFs) have seen investor interest return due to increased inflows and a closing basis trading gap. The basis trade—the difference between Bitcoin’s spot price and its futures contracts—shows a 9% improvement for institutional investors. This might mean institutional cryptocurrency investment and renewed faith in Bitcoin as an asset class.

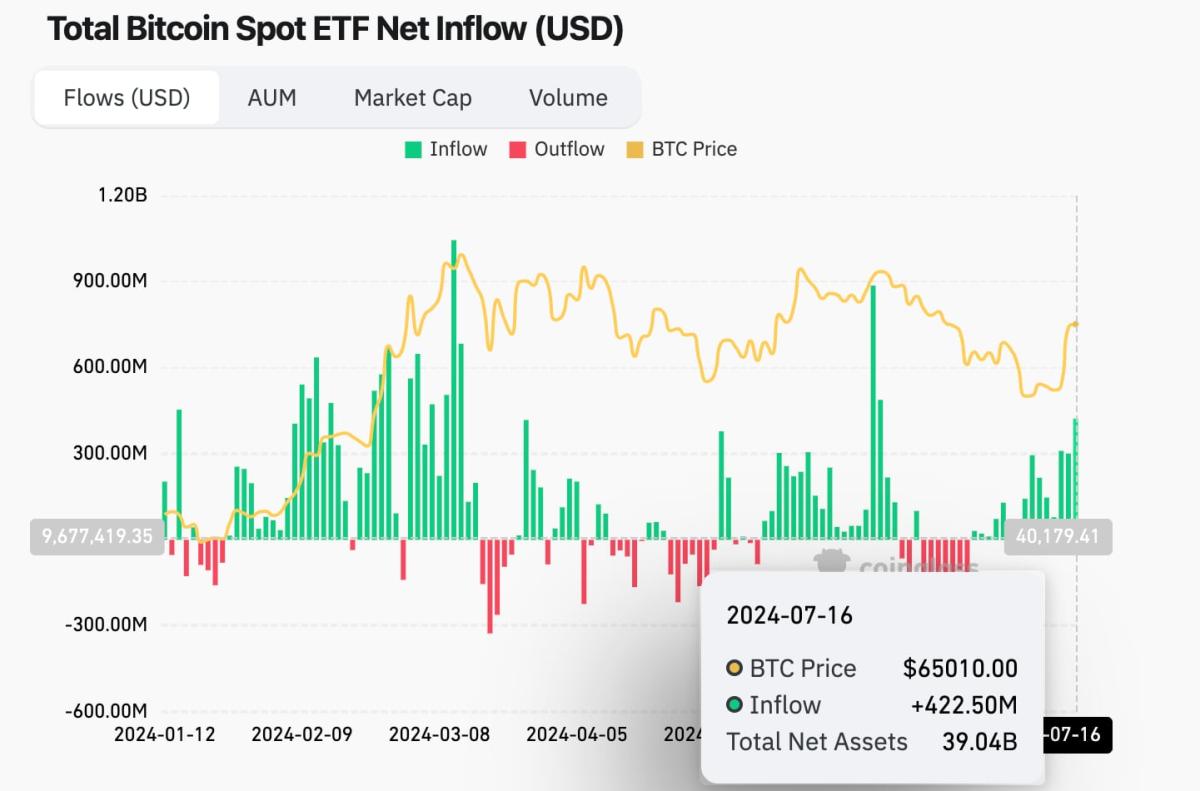

Early 2025 saw significant inflows for U.S.-listed spot Bitcoin ETFs; net investments in the first three weeks of the year totaled $4.4 billion, a 175% rise over the same period in 2024. This increase boosted the overall net inflows for Bitcoin ETFs with U.S. listings to exceed $40.6 billion. BlackRock’s iShares Bitcoin Trust (IBIT) led the flood, drawing $608.41 million in one day; Fidelity’s Wise Origin Bitcoin Fund (FBTC) and Bitwise’s Bitcoin ETF also attracted large amounts.

These inflows point to a larger trend whereby institutional investors—including asset managers and hedge funds—are using ETFs to progressively enter the Bitcoin market. Particularly for organizations that might have been reluctant to interact directly with cryptocurrency exchanges, ETFs’ simplicity and regulatory clarity have made them appealing for exposure to Bitcoin.

But as the foundation of trading narrows, such approaches lose profitability, which causes some institutional investors to change their views. For example, some hedge funds, notably Millennium Management, trimmed their holdings in Bitcoin ETFs in the first quarter of 2025 by 41%, therefore affecting the iShares Bitcoin Trust ETF. This change captures a strategic change when the arbitrage prospects lose their profitability.

Current market conditions suggest a change from short-term trading to long-term investing. ETF inflows are rising due to long-term investors holding Bitcoin as a strategic asset rather than traders benefitting from price variations, analysts say. On-chain statistics showing Bitcoin holders’ higher accumulation and decreased selling pressure support this trend.

One week, for instance. About 48,000 BTC—worth $4.5 billion—were removed from exchanges. Suggesting investors are storing assets in secret wallets. In a maturing market, players focus more on Bitcoin’s long-term potential than on short-term earnings.

The revived interest in Bitcoin ETFs corresponds with more general economic elements affecting investor behavior. Investors looking for alternative assets have been driven by worries about corporate profitability and the devaluation of the US dollar; digital currencies like. Bitcoin is seen as a new haven. Furthermore. The Trump government’s pro-crypto posture has helped to create a more favorable legal environment, therefore motivating institutional involvement in the bitcoin market.

These macroeconomic circumstances and the narrowing basis trading gap point to a larger trend toward. The institutionalization of Bitcoin investments, rather than being a transient phenomenon, suggests the current rise in Bitcoin ETF inflows. The demand for Bitcoin ETFs is projected to keep rising as more financial institutions and investors see the possibility of. Bitcoin is a store of value and a hedge against conventional market hazards.

These macroeconomic circumstances and the narrowing basis trading gap point to a larger trend toward. The institutionalization of Bitcoin investments, rather than being a transient phenomenon, suggests the current rise in Bitcoin ETF inflows. The demand for Bitcoin ETFs is projected to keep rising as more financial institutions and investors see the possibility of. Bitcoin is a store of value and a hedge against conventional market hazards.

Final thoughts

The paper emphasizes a notable change. In the dynamics of Bitcoin’s market as institutional investors see it as a long-term asset rather than a speculative play more and more. Driven by big companies like BlackRock and Fidelity. The flood of ETF inflows. Especially in early 2025, signals a fresh trust in Bitcoin. A significant change is the closing of the basis trading gap, suggesting that short-term arbitrage techniques are losing attraction. Rather, reflecting conventional investment practices, institutions are adopting Bitcoin as a store of value. The migration of Bitcoin into personal wallets points even more to a long-term investment horizon. Macroeconomic elements like worries about US currency devaluation have also fueled demand for alternative assets like Bitcoin. Driven by ETFs, the institutionalization of Bitcoin is expected to keep going, indicating its change into a popular investment asset and a counter against economic uncertainty.

An important sign of the changing dynamics in the Bitcoin market is the base trade spread of nearly 9%. Purchasing Bitcoin ETFs and simultaneously shorting Bitcoin futures contracts allows hedge funds and other institutional investors to profit on the price differences between the spot and futures markets, hence engaging in the basis trade. Usually providing better arbitrage chances, a broader basis spread attracts more institutional involvement.

An important sign of the changing dynamics in the Bitcoin market is the base trade spread of nearly 9%. Purchasing Bitcoin ETFs and simultaneously shorting Bitcoin futures contracts allows hedge funds and other institutional investors to profit on the price differences between the spot and futures markets, hence engaging in the basis trade. Usually providing better arbitrage chances, a broader basis spread attracts more institutional involvement.