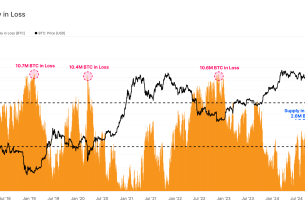

The flagship cryptocurrency, Bitcoin (BTCUSD), seems to have run out of current upward momentum as of June 19, 2025.Bitcoin momentum weakens Bitcoin’s upward trajectory may be halting, according to a number of technical and fundamental indications, following a prolonged rally that attracted the attention of investors worldwide. This event calls for a more thorough examination of the causes of the decline in bullish momentum as well as the potential implications for traders and holders going forward.

Bitcoin still has important technical support levels that could dictate its short-term course, even in the face of tiredness. The 50-day moving average, a former barrier that has now become a support region, and $32,500 are the immediate supports. The beginning of a more profound downturn may be indicated by a breach below this zone.

The $28,000 level, which has traditionally served as a solid floor throughout previous corrections, continues to be an important psychological and technical support further down. Investors will keep a careful eye on Bitcoin’s behavior in these areas to determine how strong the buyers are.

On the plus side, a good breakout over $38,000 with consistent volume would refute the bearish argument and would pave the way for a further upward phase, perhaps reaching $42,000 or more.

Because of the bullish move’s weariness, traders should exercise greater caution. Before committing to additional long positions, short-term traders may seek confirmation of reversal patterns or indications of consolidation. To reduce downside risk, protective stop-loss orders should be placed around important support levels.

On the other hand, long-term investors may see the current decline as a constructive correction within a larger period of accumulation. Since the cryptocurrency industry is notoriously volatile, corrections frequently help to shake out weaker players and create stronger foundations for future expansion.

Diversification of the portfolio is still crucial. Even if Bitcoin is still the most popular cryptocurrency, newer assets and industries like Web3, decentralized finance (DeFi), and non-fungible tokens (NFTs) can present alternate chances when Bitcoin’s growth slows down.

Bitcoin Rally Pauses

As of June 19, 2025, it seems that the recent strong trend surrounding Bitcoin has petered out. Following a robust rally, the cryptocurrency appears to be in a phase of consolidation or modest correction, according to both technical indicators and fundamental reasons. Long-term investors may have a chance to reevaluate and position themselves for future gain, even while this implies danger for short-term traders.

Whether Bitcoin can recover its bullish strength or if it will go into a longer corrective phase will be determined in the upcoming weeks. Anyone working in the bitcoin area will need to keep up with market signals and more general economic developments.

As Bitcoin approached the $38,000 resistance level, signs of a weakening rally emerged. Multiple failed attempts to break through were accompanied by volatile price action and long upper wicks, signaling increased selling pressure.

As Bitcoin approached the $38,000 resistance level, signs of a weakening rally emerged. Multiple failed attempts to break through were accompanied by volatile price action and long upper wicks, signaling increased selling pressure.  Market participants will be keeping an eye on several upcoming catalysts that could influence Bitcoin’s price trajectory:

Market participants will be keeping an eye on several upcoming catalysts that could influence Bitcoin’s price trajectory: