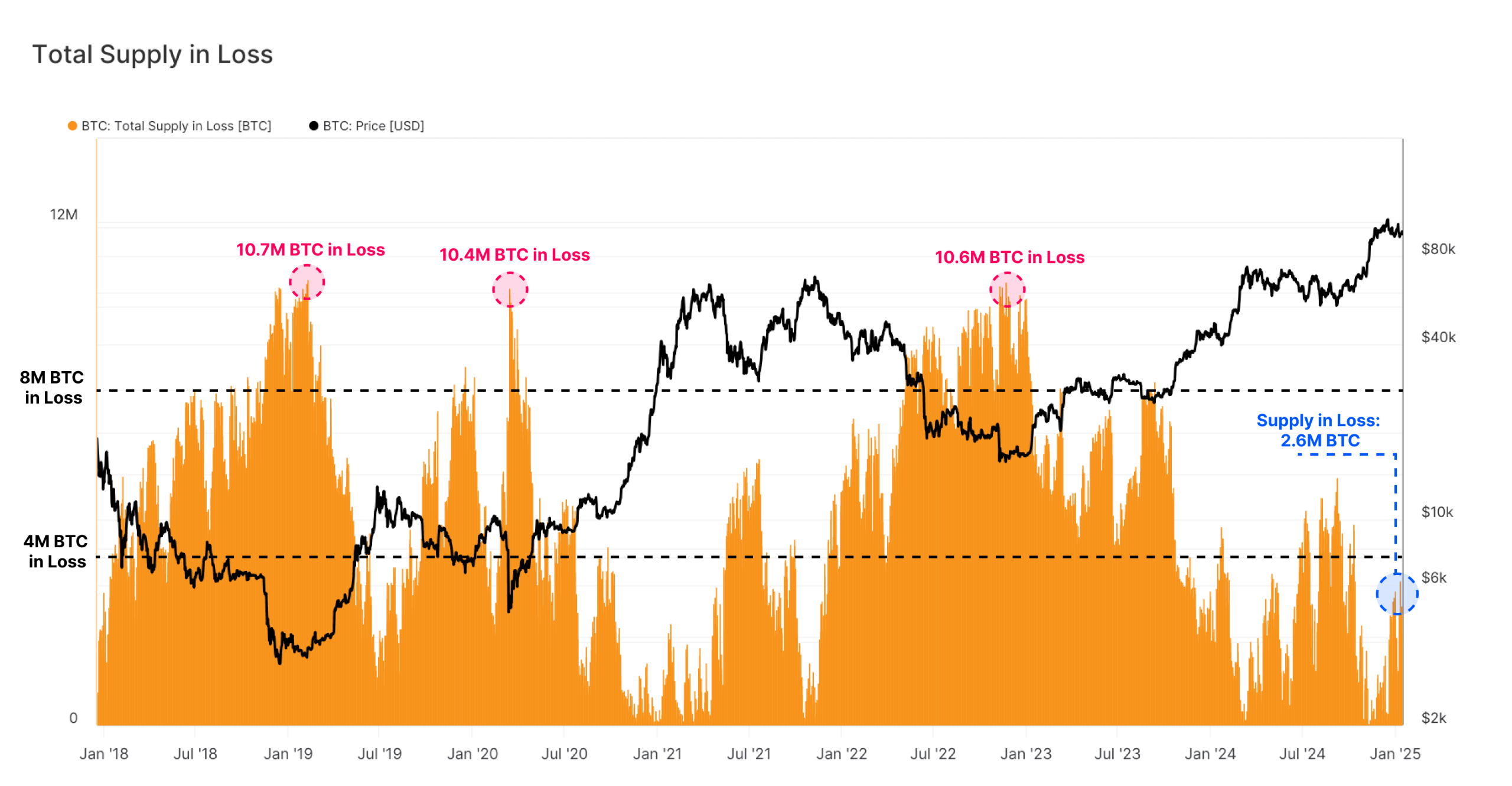

Bitcoin supply shortage. The story of Bitcoin’s scarcity is coming to a head. The amount of “old” Bitcoin—defined as coins that have not been mined in years—has significantly surpassed the amount of new supply in recent months, indicating one of the worst supply shortages in the asset’s history. Here are the factors driving the squeeze, its implications for investors, and how it might pave the way for the next significant price increase.

Bitcoin Supply Crunch

Bitcoin withdrawals from exchanges have pushed exchange-held supply below 10%, the lowest in years, limiting access for buyers. Meanwhile, long-term holders are accumulating 92% of new Bitcoin supply, reducing active liquidity and increasing coins held in cold storage.

Bitcoin withdrawals from exchanges have pushed exchange-held supply below 10%, the lowest in years, limiting access for buyers. Meanwhile, long-term holders are accumulating 92% of new Bitcoin supply, reducing active liquidity and increasing coins held in cold storage.

Accumulation Outpaces Supply

Supply dynamics are increasingly being dominated by major Bitcoin holders, also referred to as “sharks” (100–1,000 BTC) and “whales” (10,000+ BTC addresses). These groups are consuming almost 300% of the yearly mining issuance, according to data from analytics firm Glassnode.

Smaller holdings, on the other hand, have mostly ceased selling and moved into neutral or accumulation stages.

Bitcoin supply shortage. This pattern is similar to the accumulation that preceded previous bull runs. Notably, a recent on-chain research discovered that miners only contribute about 28,000 BTC per month, while smaller long-term holders are amassing almost 200,000 BTC. This indicates that the demand from loyal holders alone is outpacing the production of new coins by a factor of almost seven.

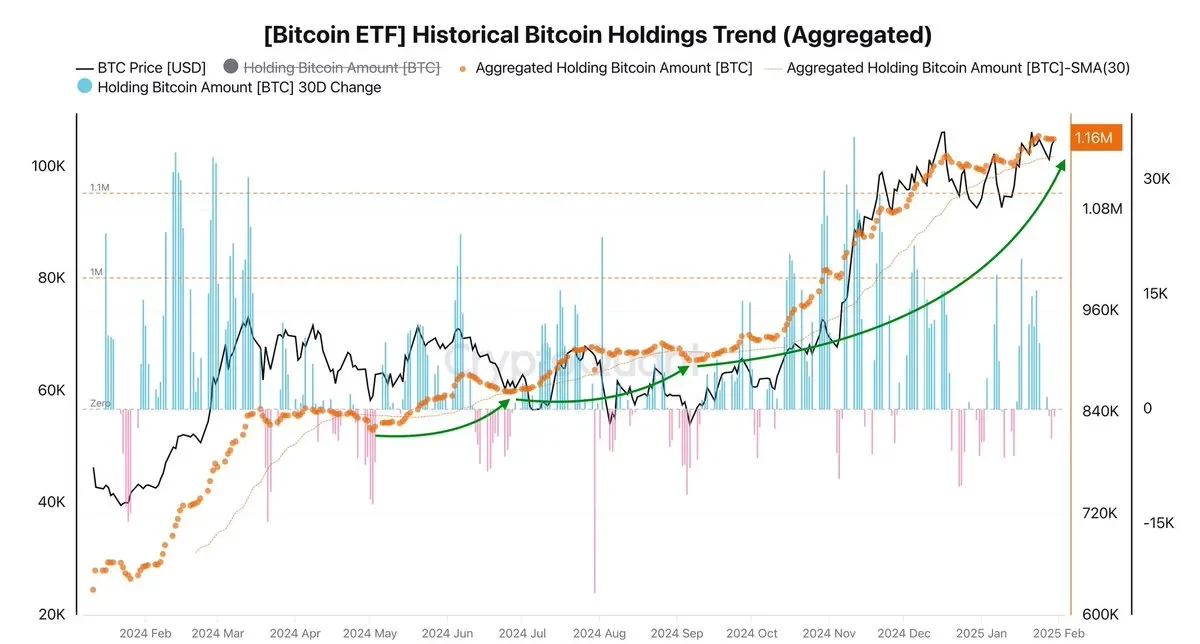

Another important driving force behind this supply shortage is institutional demand, a large portion of which is being channeled through spot Bitcoin ETFs. ETFs have swallowed three to five times as much Bitcoin each day as miners are producing, according to data.

In the face of escalating Middle Eastern tensions, Bitcoin held steady at around $105,000 on June 18, 2025, with a small decline.

Both Ethereum and XRP were trading close to slight losses; Ethereum fell by about 1.3%, and XRP fell by almost the same amount, suggesting that defensive support zones were tried but held.

This stability contrasts sharply with the early phases of the crisis (June 13), when new military bombings and a broad apprehension about taking risks led to Bitcoin dropping below $103,000.

. Altcoins were also affected by that decline, highlighting how susceptible they are to global shocks.

Markets are obsessing on U.S. Federal Reserve policies in tandem with geopolitical developments. Crypto prices were mostly unchanged after a significant stablecoin law that authorized a route for regulated digital assets was approved by the U.S. Senate earlier this week.

Investors are simultaneously preparing for the Fed’s upcoming rate announcement. Sentiment could change dramatically. If there were any signs of postponing rate reduction or, on the other hand, of accelerating them. In general, riskier assets like cryptocurrencies are favored by lower rates; pauses or hikes may cause investors to take defensive positions. Coincidentally. Monetary policy decisions may become even more complex as geopolitical pressure on oil prices may directly contribute to inflation figures.

Final thought

The article provides a thorough and insightful. Analysis of the changing scarcity dynamics of Bitcoin, emphasizing a significant change in the supply-demand equilibrium. That may pave the way for a significant price spike. A situation where new supply is being quickly absorbed and taken out of circulation. Is created by the confluence of multiple. Important factors, including declining exchange reserves, aggressive accumulation .By long-term holders. And large whales, and strong institutional demand via spot ETFs. This scarcity narrative suggests the possibility of strong. Upward momentum and is consistent with historical examples of accumulation phases before bull markets.